Company Sponsor: Goldbell Financial Services

Goldbell Financial Services (Goldbell) is a financial institution that offers various types of financing solutions to corporations and individuals, including property-backed loans, equipment loans, working capital loans and automotive loans. With just close to 40 years of history, Goldbell is already Singapore’s largest player in leasing and distributing of commercial and industrial vehicles.

Title: Credit Scoring Model

Project Team: Cheong Wei Herng Eugene, Ethan Yuzhe Yang, Loh Xiang You, Nila Chandrasekaran and Gan Jia Ying

As Goldbell grows regionally, its loan approval process needs to be enhanced to handle a larger load of loan requests. Currently, an analyst is required to vet through multiple supporting documents before approval can be given. This takes time, potentially losing customers to competitors who could provide faster approvals. In addition, each analyst decides whether to approve a loan based on their professional judgement which can be subjective. Standards differ across analysts, which may lead to Goldbell taking either excessive or inadequate risks, both posing threats to loan revenue.

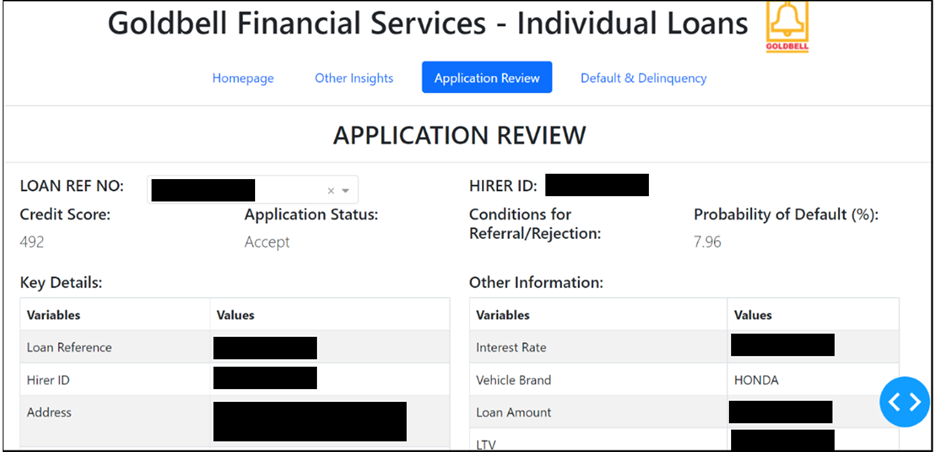

To decrease the processing time and reduce the subjective assessment, our group has developed an enhanced credit scoring engine with data analytics and machine learning capabilities. Supervised machine learning techniques which include logistic regression, classification trees and support vector machines were used. Upon keying in the applicants’ details, the engine provides an output of either “Approve”, “Reject” or “Refer”. This reduces behavioural biases from human intervention and also decreases the workload on analysts to review all applications. In addition, our credit scoring engine also generates a credit score and probability of default to provide an estimate of the risk level. Overall, this credit scoring engine is expected to reduce review time by up to 75%. The experience was a meaningful one as we saw how the solution could increase work efficiency significantly and increase the appeal of our clients’ loan offerings given the faster approvals.

A team uniquely composed of students with a background in Accountancy and students with a background in Information Systems, the project gave us opportunities for discourse from two conventionally very different fields of studies. We applied our knowledge in machine learning techniques, hire purchase loans, dashboarding and application programming interface to deliver a final product with great potential.